Starting a company can be a thrilling yet daunting task. The process involves numerous legal and administrative steps.

Company formations are crucial for legally establishing your business. Whether you’re a startup or expanding, understanding the process can save time and money. This blog post will guide you through the essentials of company formations. From choosing a business structure to filing necessary documents, we cover it all.

Get ready to navigate the complexities with ease and confidence. Let’s dive into the world of company formations and set your business on the path to success.

Introduction To Company Formations

Starting a business offers many rewards. It gives you control over your work. You can pursue your passion. It also creates jobs. Small businesses are the backbone of the economy. They bring new ideas and solutions. They also boost local communities.

Understanding company formations is essential. It helps you choose the right structure. Each structure has its pros and cons. Knowing them can save you time and money. It also ensures legal compliance. Good planning leads to business success. So, learning about company formations is a wise investment.

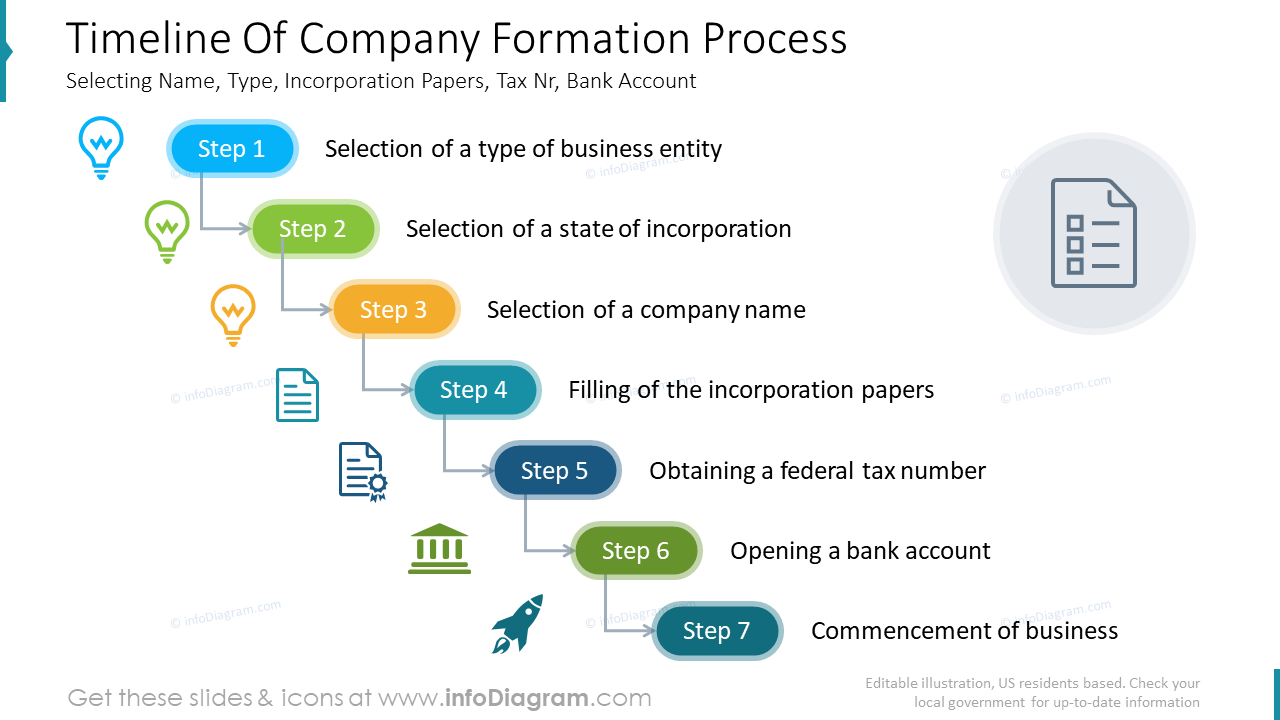

Key Steps In Forming A Company

Selecting the correct business structure is crucial. Different structures include sole proprietorship, partnership, LLC, and corporation. Each structure has its own benefits and drawbacks. An LLC offers flexibility and protection. Corporations can raise funds easily. Sole proprietorships are simple but risky. Partnerships share responsibilities and profits.

Registering your business name is essential. Ensure the name is unique. Check with local and state authorities. A unique name helps avoid legal issues. Register your name with the state. This step protects your business identity.

Securing the required licenses and permits is vital. Different businesses need different permits. Check local, state, and federal requirements. Apply for permits early. This avoids delays in starting your business. Follow all regulations to operate legally.

Unique Features Of Different Business Structures

A sole proprietorship is the simplest business form. One person owns it. The owner has complete control. Profits go directly to the owner. No separate business taxes are needed. The owner pays personal taxes on the income. This structure has risks. Unlimited personal liability is a major con. The owner is responsible for all debts. Business and personal assets are not separate. This can be dangerous for the owner’s personal finances.

In a general partnership, all partners share equal responsibility. They share profits and losses too. Unlimited liability applies to all partners. Each partner is responsible for debts. A limited partnership has both general and limited partners. Limited partners invest money but do not manage the business. They have limited liability. They are only responsible for their investment. This structure offers more protection but less control for limited partners.

A C-Corp is a standard corporation. It pays corporate taxes. Shareholders also pay taxes on dividends. This is called double taxation. An S-Corp avoids double taxation. Profits pass through to shareholders. They report it on their personal taxes. S-Corps have restrictions. There can be no more than 100 shareholders. All must be U.S. citizens or residents. Both types provide limited liability to owners.

An LLC combines features of corporations and partnerships. Owners have limited liability. Their personal assets are protected. Profits and losses pass through to personal taxes. There is no double taxation. LLCs offer flexibility. Owners can choose how to manage the business. They can be managed by members or managers. This structure is popular for small businesses. It offers both protection and flexibility.

Credit: devpost.com

Financial And Legal Considerations

Taxes can be complex. Each business type has different tax rules. Sole proprietors file taxes as personal income. Corporations face double taxation. Partnerships split profits among partners. It’s best to consult a tax advisor. They ensure you pay the right amount.

Opening a business bank account is crucial. It keeps personal and business finances separate. Choose a bank that suits your needs. Look for low fees and good customer service. Most banks require legal documents to open an account. Prepare your business license and EIN.

Legal documents are essential for any business. They include articles of incorporation and operating agreements. Compliance ensures your business runs smoothly. You must follow local, state, and federal regulations. Keeping up with laws prevents legal issues. Always consult a legal expert for advice.

Tips For A Successful Company Launch

A solid business plan is essential. It helps outline your goals and strategies. Identify your target market clearly. Include detailed financial projections. This will guide your decisions. Investors will also appreciate a well-thought-out plan.

Your brand should stand out. Develop a unique logo and slogan. Focus on your unique selling points. Use social media to reach your audience. Consistent branding builds trust. Consider running promotions to attract initial customers.

A strong team is crucial. Hire people who share your vision. Skills and experience are important. But attitude matters too. Encourage teamwork and communication. Provide training and growth opportunities. A motivated team drives success.

Credit: www.facebook.com

Credit: www.infodiagram.com

Frequently Asked Questions

What Are The Four Types Of Business Formations?

The four types of business formations are sole proprietorship, partnership, corporation, and limited liability company (LLC). Each offers unique advantages.

How Do I Structure A Company?

To structure a company, establish clear roles and responsibilities. Create departments for specific functions. Implement an organizational chart. Develop efficient communication channels. Ensure legal compliance and document everything.

What Is A Business Formation Company?

A business formation company assists entrepreneurs in legally establishing their businesses. They handle paperwork, filings, and compliance requirements.

What Is It Called When A Company Is Formed?

A company is formed through a process called incorporation. Incorporation involves registering the business as a legal entity.

Conclusion

Choosing the right company formation service is crucial for business success. Quality Company Formations offers efficient, reliable, and affordable solutions. Start your journey today and set your business up for success. For more information, visit their website and explore your options.

Your dream business is just a click away.